Theseus Pharmaceuticals

The latest biotech to throw in the towel

On Friday, Theseus Pharmaceuticals (NASDAQ:THRX) announced it was laying off 72% of its employees and seeking strategic alternatives to maximise shareholder value. Theseus closed on Monday at $3.21 per share (~$140MM market cap).

Here is the key information from the press release.

Theseus Pharmaceuticals, Inc. (NASDAQ: THRX) (Theseus or the Company), a clinical-stage biopharmaceutical company focused on improving the lives of cancer patients through the discovery, development, and commercialization of transformative targeted therapies, today announced that it is conducting a process exploring strategic alternatives to maximize shareholder value.

In conjunction with the strategic process, Theseus implemented a workforce reduction of approximately 72%. This includes Theseus’ President of Research and Development, William C. Shakespeare, Ph.D., who will continue to support the Company in a consulting capacity until June 30, 2024.

As part of this process, the Company plans to consider a wide range of options with a focus on maximizing shareholder value, including potential sale of assets of the Company, a sale of the Company, a merger or other strategic action.

As of September 30, 2023, Theseus had cash, cash equivalents, and marketable securities of $225.4 million.1

Theseus’ had 43.6MM shares outstanding as of June 30. Thus, Theseus’ September 30 cash balance is ~$5.17 per share.

Theseus has a very clean balance sheet, so it’s fairly easy to get to an estimate of the company’s residual value in a liquidation scenario. That said, as liquidations are very rare in these sorts of situations, it seems to me that THRX should trade at some sort of discount.

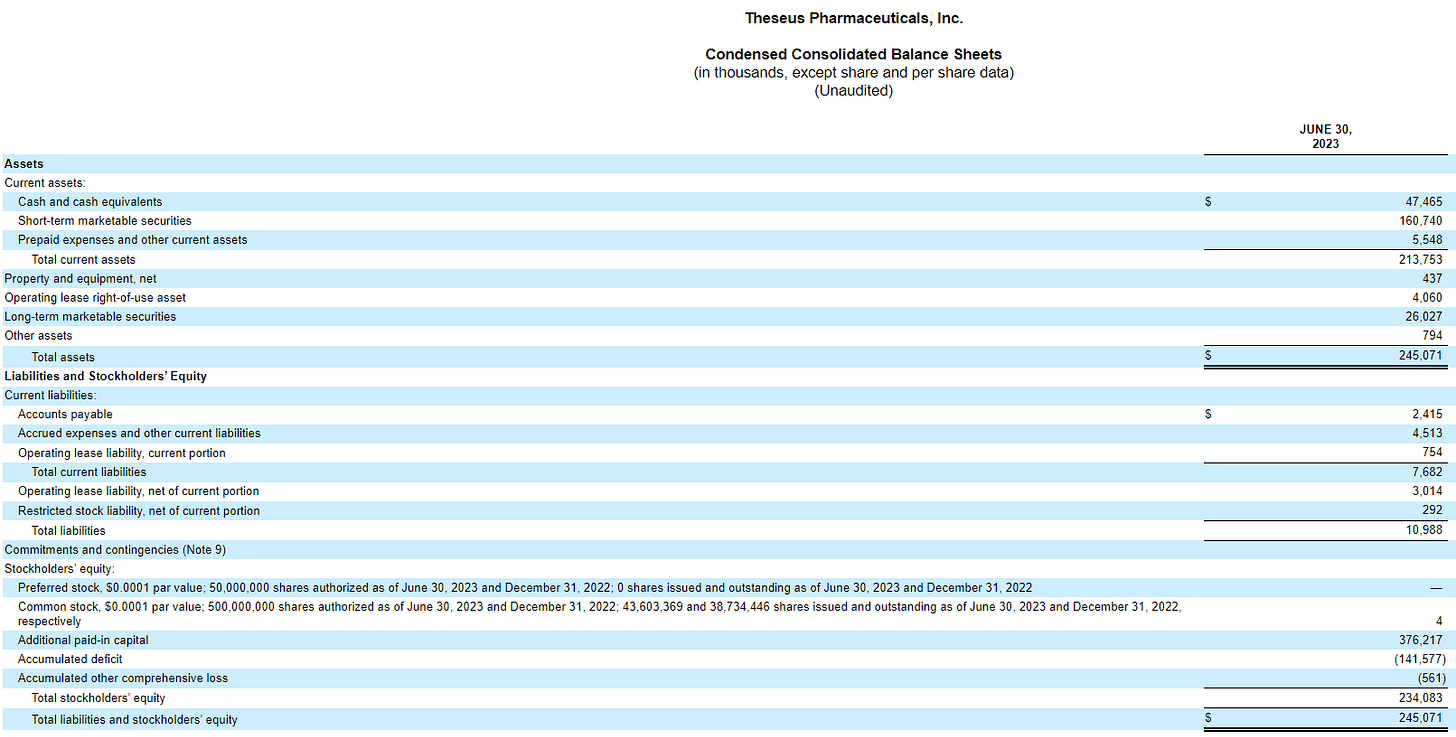

We don’t have a balance sheet for Q3; here’s the balance sheet from Q2.

You’ll see the company had $234.2MM net cash and securities and $11MM in liabilities (including ~$3.8MM in lease liabilities). Besides the cash, there is $5.5MM in prepaid expenses, $437K in PP&E and $794K in other assets — $6.8MM total for these items.

Cash burn has been stable over recent quarters, with operating expenses hovering between $15.5MM-17.6MM per quarter over the year to June 30. In Q2, THRX had operating expenses of $17.6MM and earned $2.8MM of other income, mostly interest on its cash and securities, for a net loss of $14.8MM. Note that this includes $3.6MM of SBC expense, which doesn’t really reflect reality in this case. If you ignore the SBC, you get to ~$11.2MM in cash burn for Q2 (roughly 26 cents per share/quarter).

Here’s how I think about THRX’s liquidation value:

I’ve started with the September 30 cash balance of $225.4MM.

It seems likely to me that the liabilities for Q3 will be roughly the same as Q2, so I’ve subtracted $12MM for estimated outstanding liabilities.

I’ve assumed a further $12MM for cash burn in Q4 (which gives no credit for reduced costs from workforce reduction) and $6MM in restructuring costs (including Mr Shakespeare’s severance).

I’ve assumed another $15MM on top of that for remaining severance, further cash burn, wind down costs and professional fees — note that this is just a guess, but it seems reasonably conservative.

That gets us to about $180.4MM by Q2, 2024 — which works out to $4.14 per share.

A few notes about these numbers:

I have not given any value to THRX’s PP&E, prepaid assets or other assets. I don’t know if they’d be worth much (if anything), so I think it’s safest to value them at zero. If they do turn out to be worth something, there could be further upside.

William Shakespeare, the president of R&D who was terminated in the workforce reduction, has been retained as a consultant with a remit to seek to out-license THRX’s legacy THE-349 and BCR-ABL programs. I’ve assumed zero value for these, but again they could be worth something. Mr Shakespeare is not entitled to salary for his consulting, but his equity awards will continue to vest until the termination of the consulting agreement (which expires on June 30, 2024, unless earlier terminated). According to a filing from November 7, Mr Shakespeare beneficially owns 639,408 shares — worth roughly $2MM. Thus, it seems like he is well incentivised.

Here is how the company describes the THE-349 and BCR-ABL programs.2

THE-349 is a fourth-generation epidermal growth factor receptor (EGFR) tyrosine kinase inhibitor (TKI) product candidate with activity against single-, double-, and triple-mutant EGFR variants, including T790M and C797X, found in EGFR-mutant non-small cell lung cancer (NSCLC) that has developed resistance to first- or later-line osimertinib.

Preclinical data demonstrate that THE-349 can potently inhibit all major classes of EGFR activating and resistance mutations observed in a post-first- or later-line osimertinib setting, possesses kinome and wild-type EGFR selectivity, and has central nervous system (CNS) activity.

IND-enabling toxicology studies have been completed, and Theseus remains on track to submit an Investigational New Drug Application (IND) for THE-349 in the fourth quarter of 2023, and commence its clinical program as soon as possible thereafter, subject to clearance of the IND by the U.S. Food and Drug Administration.

BCR-ABL Program: Theseus is aiming to develop a potent and selective, next-generation, pan-variant BCR-ABL TKI candidate that optimizes the balance of safety and efficacy for patients with relapsed/refractory chronic myelogenous leukemia (CML) and patients with newly diagnosed Philadelphia chromosome-positive (Ph+) acute lymphoblastic leukemia (ALL).

Theseus plans to pursue clinical development in patients with CML who have been previously treated with a second-generation TKI or have the T315I mutation, and in newly diagnosed patients with Ph+ ALL.

Preclinically, Theseus lead molecules have shown a high degree of potency against BCR-ABL and clinically relevant resistance mutations, such as the T315I gatekeeper mutation, and substantial kinome selectivity.

Theseus expects to nominate a development candidate for this program in the first half of 2024.

In July, Theseus discontinued enrolment in a Phase 1/2 study of THE-630, a drug being developed for patients with gastrointestinal stromal tumors (GIST), due to safety concerns. Thus, THE-630 is unlikely to be attractive to other biotech companies — and its sale wasn’t contemplated in Mr Shakespeare’s consulting agreement.

It seems that the THE-349 and BCR-ABL programs could be worth something to the right buyer, but it’s a terrible market for biotech companies at the moment, and it’s hard to value these assets. I’ve assumed zero value, but there could be some upside in the event of a sale.

With all that in mind, we’re left with:

About $180.4MM in estimated liquidation value at Q2, 2024 ($4.14 per share);

Plus, any upside from THRX’s ~$6.8MM non-cash assets, which I’ve valued at zero;

Plus, potential savings from early terminations of the company’s ~$3.8MM in leases;

Plus, any upside in the event of a sale of the legacy clinical programs.

With shares trading around $3.25, THRX still seems interesting, despite the huge run up in price.

The key risk is that Theseus’ board pursues a reverse merger or other transaction that the market dislikes. If they were to simply sell the company or liquidate and return cash to shareholders, it would almost certainly work out very well from here — but that seems far from certain.

If you’ve looked at this yourself, I’d be interested to hear your thoughts.

https://www.sec.gov/Archives/edgar/data/1745020/000174502023000073/thrx-20231113xexx991.htm

https://www.prnewswire.com/news-releases/theseus-pharmaceuticals-announces-business-highlights-and-reports-second-quarter-2023-financial-results-301897368.html

An important update on this situation: Kevin Tang has made a non-binding offer for $3.80 per share plus CVR (for 80% of net proceeds of THRX’s programs: https://www.sec.gov/Archives/edgar/data/1745020/000121465923015548/d1124230sc13d.htm

Meanwhile Orbimed and Foresite have also sent the board a non-binding EOI for a privatisation offer, without disclosing a price: https://www.sec.gov/Archives/edgar/data/1745020/000095014223002837/eh230423669_ex01.htm

These are very positive developments as it means the company will almost certainly be sold, removing the risk of a bad reverse merger.

I forgot to add information about the major shareholders. Per most recent disclosures, Orbimed owns 40.6% and Foresite owns a further 12.6%. A number of other biotech funds are on the register. Hopefully this bodes well for a good outcome.