The curious case of Cyteir Therapeutics

A busted biotech trading at a 59% discount to liquidation value.

When it comes to investing, an important skill is what poker players call game selection. In the poker world, it means finding the right opponents to play against. In the investing context, it’s what Charlie Munger is referring to when he says “fish where the fish are”.

At the moment, I believe one particularly attractive “game” for value investors is busted biotechnology companies. With interest rates rising, it’s become very difficult for cash burning biotechs to find funding. As a result, many of these companies are facing reality and reviewing “strategic alternatives” — i.e. finding the best available option for a reverse merger — or simply liquidating.

What is interesting is that many of these companies are currently trading at big discounts to cash — and there are more of these biotech net-nets around than usual.

These biotech situations have been profitable for me in recent months. In September, after reading a write-up by Clark Street Value, I purchased shares in Imara Inc (NASDAQ:IMRA) for around $2.05 per share. Imara ended up doing a reverse merger with Enliven Therapeutics. I sold my shares too early, but Enliven currently trades for $21.09 per share ($5.27 adjusted for the 1-for-4 reverse split). Another recent example is Metacrine, which traded at a deep discount to cash after announcing a stock-for-stock merger which the market didn’t like. The merger was eventually called off and the company is currently being liquidated.

Before I go on, I should point out that there are a number of risks with these sorts of situations. Often, management has little regard for shareholder value and they often own little or no stock themselves. Sometimes they have incentives which go against those of equity holders: for example, they may choose to prioritise transactions that preserve their own jobs, or those of their employees. Sometimes, you buy a company like IMRA for its cash and then it does a reverse merger with another cash-burning clinical stage biotech company. While sometimes you get lucky, other times you end up with your cash diluted without much to show for it.

There are a couple of ways you can mitigate these risks. It makes sense to own a basket of these situations to diversify your exposure to any one situation. Otherwise, you could be extremely picky, and try to only find situations with a margin of safety sufficient to warrant high conviction. This is the sort of idea I’m most interested in personally, and it’s one of these that I’m going to outline today.

Introducing Cyteir Therapeutics Inc (NASDAQ:CYT)

The investment case for Cyteir is quite simple. At the time of writing, Cyteir currently trades at $1.62 per share. There are roughly 35.44 million shares outstanding, along with some options which are mostly well out of the money. Cyteir’s market cap is therefore roughly $57.4MM (USD). The company focuses on discovering precision oncology medicines that cause cancer cell death through a therapeutic strategy known as synthetic lethality.

In January, Cyteir announced it was suspending enrolment in Phase 2 monotherapy trial for its lead candidate, CYT-0851, due to insufficient observed activity. In conjunction with this announcement, Cyteir announced it would reduce its workforce by 70% and pivot to developing CYT-0851 as a combination therapy for ovarian cancer.

The press release noted:

Based on current estimates, including assumptions for continuation of clinical development of CYT-0851 towards registration as a combination therapy, Cyteir expects that these actions will extend its cash runway into 2026. As of December 31, 2022, on an unaudited basis, Cyteir had approximately $147 million in cash and cash equivalents. Cyteir estimates that it will incur aggregate charges of approximately $2.5 million to $3 million, all of which are anticipated to result in future cash expenditures, primarily for one-time employee severance and benefit costs, the majority of which are expected to be incurred in the first quarter of 2023.

CYT now has two remaining research programs, which involve the use of CYT-0851 in combination with two existing cancer drugs, capecitabine and gemcitabine. It seems that the focus will be on capecitabine, according to the press release:

The prioritization follows encouraging preliminary clinical activity in a small number of patients observed in the Phase 1 dose escalation cohort with CYT-0851 in combination with capecitabine in advanced ovarian cancer. Cyteir plans to expand its evaluation of CYT-0851 in combination with capecitabine to treat advanced ovarian cancer and enroll additional patients in the first half of 2023 to further support these early signals. If successful, the combination of CYT-0851 with capecitabine has the potential to be an all-oral treatment for ovarian cancer.

The press release provided some further detail on the combination therapies:

Phase 1 dose escalation cohorts with CYT-0851 in combination with capecitabine for the treatment of advanced ovarian cancer have shown encouraging preliminary clinical activity. To date, thirteen patients have been treated with CYT-0851 (from 100-400mg daily) and capecitabine, including five patients with advanced ovarian cancer. Responses and disease stabilization observed in these ovarian cancer patients in the 300mg and 400mg CYT-0851 dose levels are encouraging, and have led to Cyteir’s decision to focus on further development of this capecitabine combination in advanced ovarian cancer. Overall, CYT-0851 continues to be generally well tolerated with no new safety concerns.

In the first quarter of 2023, Cyteir expects to determine a maximum tolerated dose (“MTD”) for CYT-0851 in combination with capecitabine and focus its efforts on enrolling and treating additional patients with advanced ovarian cancer at the MTD. If the data from these additional patients further support Cyteir's focus on ovarian cancer, Cyteir intends to pursue development and potential registration of CYT-0851 in combination with capecitabine as an all-oral treatment for platinum resistant ovarian cancer.

In addition, Cyteir is evaluating CYT-0851 in Phase 1 dose escalation cohorts in combination with gemcitabine. To date, ten patients have been treated with CYT-0851 (from 100-200mg daily) and gemcitabine. Cyteir will continue the ongoing dose escalation cohorts with CYT-0851 and gemcitabine in solid tumor patients to identify an MTD, which could provide an additional opportunity to develop CYT-0851 as a combination therapy to treat patients with platinum resistant ovarian cancer.

According to the press release, Phase 1 combination data for CYT-0851 is expected to be disclosed in mid-2023. Importantly, even if CYT-0851 is found to be effective as a combination treatment for ovarian cancer, it seems that the target market would be only ~13,000 patients in the US.

In the United States, it is estimated that a total of approximately 13,000 patients are available for drug treatment per year who are platinum resistant and have progressed after two lines of prior therapy, or have progressed after at least three prior lines of therapy.

This is unlikely to be a lucrative drug, even if it is viable, which could explain why Cyteir’s board has taken drastic action to preserve the company’s remaining cash.

Liquidation value analysis

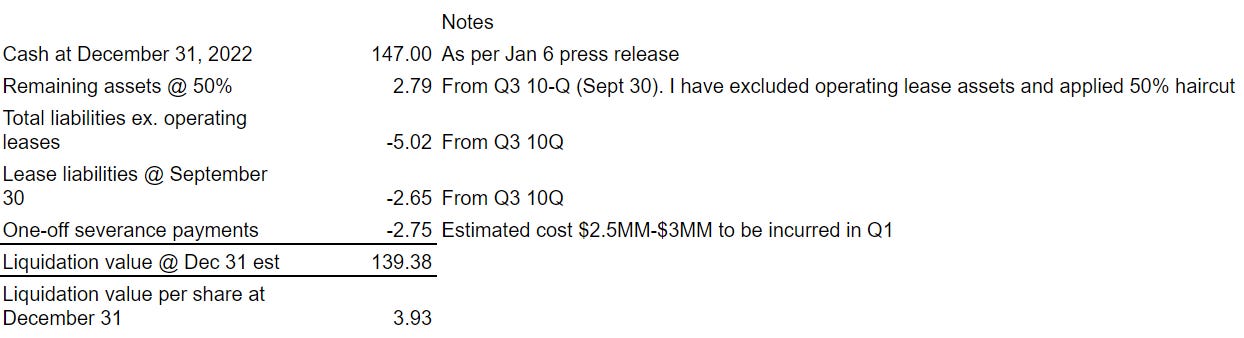

CYT appears to be an attractive investment as it is trading at a substantial discount to cash while having a relatively low burn rate. I estimate that CYT had a liquidation value of approximately $140MM as of December 31, or $3.93 per share. At the current price, 1.62, you are buying at a 59% discount to this value.

I reached this number by taking the $147MM cash balance from the press release and subtracting the one-off severance payments along with the total liabilities at Cyteir’s last balance sheet date (September 30).

This seems a reasonable proxy for CYT’s current liquidation value. If we assume zero value for ex-cash assets, rather than a 50% haircut, it would shave off roughly 8 cents per share of value, leaving us with $3.85. I have not subtracted any costs for liquidation expenses, which should be negligible in comparison to the cash.

Next, we can look at Cyteir’s cash burn. In Q3, CYT had R&D expenses of $8.27MM and G&A expenses of $3.5MM — for total operating expenses of $11.76MM. However, this includes stock-based compensation of $1.19MM which does not seem to be a true expense. CYT had 1,385,082 options vested and exercisable as of September 30, 2022, with an aggregate intrinsic value of $427K. If we include the unvested options, there are 3,659,788 options with aggregate intrinsic value of $752K. So, the SBC expense in the quarter is significantly higher than the intrinsic value of all options outstanding. The average weighted average exercise price for the options is $5.50, which is multiples of today’s price.

The 10-Q notes:

As of September 30, 2022, there was $8.7 million of unrecognized stock-based compensation expense related to the share-based compensation arrangements under the 2012 Plan. The Company expects to recognize this amount over a weighted-average period of 2.2 years.

Thus, Cyteir’s SBC expenses is unlikely to be a true expense. If we exclude that from the burn rate, Cyteir’s quarterly expenses are roughly $10.6MM, and that’s prior to the 70% workforce reduction. If we are conservative and assume operating expenses only reduce by roughly 50%, we are left with a quarterly burn rate of around $5MM or $20MM annually.

By my estimates, CYT should have roughly $119.4MM in liquidation value after four quarters of cash burn, or $3.37 per share. Today’s price represents a 52% discount to that number. This seems very attractive and the margin of safety is substantial.

Why I like Cyteir more than the average busted biotech

Cyteir has not announced a formal review of strategic alternatives, but there are signs something could be brewing. Cyteir had 40 employees according to last year’s 10K, which implies the company will only have about 12 employees following the workforce reduction.

As part of the reduction, CYT will eliminate both its chief business officer and chief scientific officer. Meanwhile Cyteir’s CEO, Dr Markus Renschler, was given a retention incentive equal to 150% of his current salary contingent on him remaining employed with the company until at least 2023. The chief scientific officer, Paul Secrist, was also given a retention incentive equal to two months base salary, contingent on him remaining employed with the company until April 1, 2023. This date appears to coincide with the timeline for the Phase 1 combination data from CYT-0851. (The January 19 press release noted: “Cyteir plans to disclose the Phase 1 combination data for CYT-0851 in mid-2023.”)

While it is hard to draw firm conclusions, these developments suggest to me that CYT’s board is acting rationally and seeking to preserve shareholder value. Also, many of CYT’s pre-IPO investors are now deeply underwater and may be seeking their money back.

Cyteir’s shareholder base

Prior to listing, Cyteir raised money in a series of preferred stock offerings.

In October 2015, Cyteir issued 5,817,996 shares of Series A redeemable convertible preferred stock at a price of $1.00 per share

In 2018 and 2019, Cyteir issued 55,200,000 shares of Series B preferred stock at a price of $1.00 per share

In February 2021, the Company issued 21,784,885 shares of Series C redeemable convertible preferred stock at $3.67 per share.

As part of the IPO process, all the preferred stock was converted to common at a rate of 1 common to 0.2934 preferred. This represents 69% of Cyteir’s shares outstanding as of today. Cyteir also issued 8.3 million shares in its IPO in June 2021 at $18 per share.

Today, the Series A & B rounds are down about 52%, the Series C round is down 87% and the IPO shares are down 91%.

Cyteir is closely held by institutions, many of whom participated in the company’s pre-IPO funding rounds. Interestingly, shareholders who participated in the Series A and B rounds could still walk away with profits if the company was liquidated today.

The top 10 shareholders own 74% of the company. Markus Renschler, MD, Cyteir’s president and CEO, owns roughly 1 million shares, along with options, so he seems well incentivised.

Novo Holdings, Cyteir’s largest shareholder

The largest shareholder is Novo Holdings A/S, a holding company which is part of the Novo Nordisk group of companies. Novo currently owns 3,940,413 shares, 11.1% of the company.

Karen Hong, a partner at Novo Ventures, joined the board of Cyteir in October 2019, which coincided with the company’s Series B round. Ms Hong resigned as a member of the Cyteir board on December 15, 2021. Her departure came at the time of Dr Jeffrey S Humphrey’s appointment to the board. It is unclear why Ms Hong resigned.

In September 2022, Novo filed an amended 13D. There was no change in ownership disclosed. The filing included a change in language under item 4, which requires substantial holders detail the purpose of their transactions in certain circumstances. There was some interesting new language in the filing:

Depending on various factors including, without limitation, the Issuer’s financial position, results and strategic direction, actions taken by the Issuer’s management and Board of Directors (the “Board”), other investment opportunities available to Novo Holdings A/S, the price levels of the Issuer securities, conditions in the securities markets and general economic and industry conditions, Novo Holdings A/S may in the future take such actions with respect to its investment in the Issuer as it deems appropriate including, without limitation, engaging in communications and information exchanges with the Issuer’s management and Board, engaging in discussions with shareholders of the Issuer or other third parties about the Issuer and Novo Holdings A/S’s investment, making recommendations concerning changes to the Issuer’s operations, governance or capitalization, potential business combinations or dispositions involving the Issuer or certain of its businesses, or suggestions for improving the Issuer’s financial and/or operational performance, acquiring additional Issuer securities, disposing of some or all of such securities, or changing its intention with respect to any and all matters referred to in Item 4.

While this could simply be legal boilerplate, it could foreshadow engagement with the board and shareholders from Novo. Clearly, this has been a horrible investment for them and perhaps they are seeking to preserve the company’s remaining value. The strategic pivot and workforce reduction was announced on January 19, roughly one and a half quarters after Novo’s filing.

BML, which owns 7.7%, is involved in a number of biotech plays. They were also involved in Metacrine, and threatened to vote against the company’s merger proposal. Subsequently, the merger was called off and Metacrine announced it would liquidate. It is unclear how much influence BML has in this situation.

Risks

There are a number of potential outcomes here.

Cyteir is reporting Phase 1 combination data for CYT-0851 in mid-2023. If the data does not support further development, I suspect that Cyteir will seek to maximise value for shareholders via a reverse merger or liquidation. Typically, companies seek a reverse merger in the first instance and then liquidate if the merger falls through. Considering CYT currently trades at a more than 50% discount to cash less total liabilities, this should be a positive for shareholders. The fact that Novo and other major shareholders will be pushing for a good outcome should reduce the risk of a bad merger being approved.

If Cyteir report positive data in mid-2023, they could seek to continue development. I suspect a positive readout could be good for the stock, as it would suggest that CYT-0851 may have some value. (Currently, the market is applying a negative value to CYT’s IP.) While this would lead to more development expenses, CYT has said the workforce reduction will extend its cash runway until 2026.

Cyteir could also seek to sell CYT-0851 to another company to continue to develop it. I suspect this may be what is currently being considered, considering the company now only has 12 employees. Why would they reduce their workforce by 70% if they were still seriously considering developing it themselves?

Novo or another shareholder could go activist and push Cyteir to halt its development programs and return cash to shareholders.

Personally, I find it hard to see much downside with Cyteir. I have thus sized it much larger than I would with a typical busted biotech play. I’m interested to hear how I might be wrong, so if you have any feedback or concerns, please let me know in the comments.

A quick programming note

For those who enjoyed my first write-up on CEL Corp, I’m planning to write a review of the company’s annual results when they’re published. So far, the idea is up about 16%. It’s still very cheap, and Q3 earnings were ahead of the company’s full-year forecast. It’s still my largest position and it still trades at a discount to cash less total liabilities.

Also, I recently turned on Substack’s pledge subscription feature. This is only my second post, so I’m not turning on a paywall yet, but if you enjoy my work, or if you’ve made some money on CEL, you are welcome to pledge a subscription. I was very flattered to find out that two people have pledged already — thanks very much Hewitt and Andreas. I try to focus on quality over quantity with my write-ups, and my time is limited due to my day job. If more people subscribe, I can spend more time on writing the Substack, which will hopefully be a win-win.

Take a look at SNPX. $37.5mm in cash at year end (they closed on a $15mm preferred in Nov) with 7.35 million shares of common. Phase 2 came back in Jan with inconclusive findings ie. not statistically significant. Mgt announced this month the obligatory, "we are encouraged, blah, blah, blah, we are reviewing strategic options, blah, blah " Cash burn is a little under $3mm/qtr before the Phase 2 findings, so perhaps they can shrink that headcount on that failure. And the company is left with about $3 cash per share (assuming the preferred is repaid in full), and the stock is trading at $0.84 or about a >70% discount.

Excellent piece. I appreciate your approach and cutting the info down to what's integral to the thesis.