A profitable Japanese microcap trading at a 53% discount to NCAV

My deep dive on CEL Corporation (5078.T)

A quick note: I’ve imported the email list from my old blog, so if you’ve received this email without subscribing, it’s because you were signed up. I hope that’s OK!

I’ve been listening back to the old Berkshire Hathaway annual meetings in my spare time lately. In the 1995 meeting, Buffett talks about an investment he made in a cigar butt, the Delta Duck Club.

WARREN BUFFETT: There were 98 shares outstanding. It was the Delta Duck Club. And the Delta Duck Club was founded by a hundred guys who put in 50 bucks each, except two fellows didn’t pay, so there were only 98 shares outstanding.

They bought a piece of land down in Louisiana, and one time somebody shot downward instead of upward, and oil and gas started spewing forth out of the ground. (Laughter)

So, they renamed it Atled, which is Delta spelled backwards, which was — sort of illustrated the sophistication of this group. (Laughter)

And a few years later, they were taking up — at $3 a barrel oil — they were taking about a million dollars a year in royalties out of the place. And the stock was selling at $29,000 a share, and it was earning $10,000 a share —

No, it was earning about $7,000 a share after-tax, about 11,000 pretax, and it had about 20,000 a share in cash. And it was a long-lived field.

So, you know, I use that sometimes as an example of efficient markets, because somebody called me and offered me a share of it, and those things, you know — is that an efficient market or not?

You know, 29,000 for 20,000 of cash, plus 11,000 of royalty income at 25 cent gas and $3 oil? I don’t think so.

You can find things out there. I’ll give you hunting rights on all my duck clubs in the future.

While you might assume these sorts of situations no longer exist, that has not been my experience. For example, Japan is full of Ben Graham’s net-nets. As of November 15, there were at least 88 net-nets, according to Net-Net Value.

Don’t get me wrong, many of these companies deserve to trade well below book value. Some earn returns below the cost of capital, while others hoard cash on the balance sheet for years. As there is little shareholder activism in Japan, cheap Japanese companies have a habit of staying cheap.

Occasionally, though, you find an extremely cheap company in Japan without the usual encumbrances — like CEL Corporation (5078.T). CEL has a market cap of ¥7.3B (AUD $77MM) and average daily trading volume of roughly 4,700 shares (~$100K AUD).

Like Buffett’s Delta Duck Club, CEL’s value is obvious. It is one of Graham’s net-nets: CEL has ¥4,175 per share in net cash and ¥4,458 per share in NCAV (net current assets less total liabilities) compared to market price of ¥2,109 per share at the time of writing.

Besides the cash, CEL also has a profitable operating business, which is forecast to earn ¥181 per share this year and pay ¥80 per share in dividends (~3.8% yield). I believe the operating business alone supports the current market valuation, which would imply that CEL is trading at roughly one-third of its value to a private owner. To highlight the sheer value here, consider that if you simply took CEL’s cash and subtracted its total liabilities, you’d still be left with ¥3,173 per share (~50% upside from current prices).

My view is that CEL is not a typical Japanese value trap for three reasons:

The cash comes from a one-off asset sale. CEL hasn’t been building cash on the balance sheet for years. While management has no intention of paying out the cash at present, they plan to use it for acquisitions. It won’t stay on the balance sheet for ever.

CEL’s operating business is not a great business, but it’s not terrible either. CEL earned an average of 15% pretax on capital employed over the last three years (FY20-FY22). The operating business earns above its cost of capital, is consistently profitable and ~40% of earnings are paid out as dividends.

Management has a lot of skin in the game. CEL’s founder and president, Masatsugu Shinno, owns 60% of the company, which aligns his interests with shareholders.

Full disclosure: CEL is the largest position in my portfolio.

Business overview

CEL Corporation builds and manages apartments in the Tokyo metropolitan area.

It has three operating segments:

Rental housing: CEL designs and builds apartments and provides support services to its customers. The apartments are aimed at younger people (25-35) in the Tokyo metropolitan area.

Rental development: CEL buys land to develop apartments for lease or sale. The developments are all in Tokyo, within walking distance of train stations. The developments range from 9-28 units. This is CEL’s smallest business segment by revenue.

Rental management: CEL provides rental management services, including subleasing, rent collection, maintenance and rental guarantee. As of February 28, 2022, CEL managed 11,228 units.

The rental sales segment is the largest by revenue, with a 41% share in FY22. The rental management segment is the largest in terms of profit, with 62.4% share. N.B. The Chinese assets were sold in December, so the China rental segment has been discontinued.

While CEL has experienced little to no sales growth in recent years, the combined operating businesses generated ¥8.44B in operating income between FY17-FY22. Net income in the five years from FY17-FY21, prior to extraordinary gain on sale of the Chinese segment, was ¥4.96B, roughly 68% of the current market cap.

While the rental housing and development businesses earn low returns on capital, the rental management business is much more attractive. The management fees are a recurring revenue stream, and the segment requires very little capital. It’s also less cyclical.

CEL targets operating margins of 6%, and a capital adequacy ratio of 60% (net assets/total assets). A recent company presentation notes a long-term vision for sales of >¥100B, compared to around ¥20B today, and operating margins of 10%. According to CEL’s IR, management is seeking to increase the sales and operating income of the domestic business by 5-10% each year, “while keeping a firm footing and avoiding unreasonable expansion”. CEL’s policy is to maintain a dividend pay-out ratio of at least 30%, however the company is guiding to a 44.1% consolidated pay-out ratio in FY23. In FY21, the pay-out ratio was 45%.

CEL’s ¥10B property sale

CEL’s Chinese business owned a factory site in Ningbo City, Zhejiang province. The site was in an area that was targeted for urban redevelopment by the government.

After discussions with the local government, CEL entered a equity transfer agreement with Ningbo City Contemporary Service Industry Development Co., Ltd, a state-owned enterprise. Under the agreement, CEL disposed of Chinese subsidiary, CEL China Co Ltd, and the property for consideration of 900MM RMB after payment of corporate tax. The transfer closed in December, 2021, and CEL received the cash in early 2022. In its FY22 financials, CEL recorded extraordinary income of ¥16.6B from the gain on transfer of the Chinese subsidiary. After taxes, the sale added about ¥10B cash to CEL’s balance sheet — ~135% of CEL’s current market cap.

CEL’s IR department confirmed the cash has been converted to yen and deposited at a Japanese bank. Management are not currently contemplating a special dividend, and it seems the money will likely be used for acquisitions.

Our policy is to use the funds obtained from the sale of the China business to invest in businesses that will bring synergy to our current business and lead to increased profits and further growth, but we would like to continue discussions and make a decision based on the current global situation and market conditions.

— CEL’s IR department, response to my questions via email

There has been no firm deadline set for the cash to be deployed.

Why this opportunity is available

There are a few very peculiar things about CEL. For starters, when you find a stock selling below cash value, usually it is a long-forgotten company in a redundant industry. CEL, however, only listed in March 2022.

The listing itself was a very interesting exercise. The company sold a total of 522,100 shares in the listing: 206,200 of the shares sold were treasury shares; Mr Shinno, the founder and majority owner, sold 284,000 shares in a secondary offering; and 31,900 shares were issued to underwriters under the over-allotment scheme. The over-allotment shares were the only new shares issued in the listing. The offering price was ¥1,900. The company had no need for cash; there was cash on the balance sheet and the sale of the Chinese subsidiary had already been announced.

The important question, then, is: why would the founder sell shares at ¥1,900 when less than a year later, the shares have ~¥5,270 in net tangible asset backing, mostly in cash. When I asked CEL’s IR department about this, this was the response:

The purpose of listing in our company was to further strengthen governance, not to raise funds. Against this background, we had planned to issue new shares at the time of listing, but due to the unplanned acquisition of funds associated with the transfer of our China business just prior to the approval of listing, it became difficult to issue new shares. Therefore, in order to fulfil the purpose of the listing, Mr Shinno, our representative director, decided to sell his shares.

I’m not sure what to make of this exactly. However, it does explain Mr Shinno’s behaviour. I also believe that CEL may have been in a rush to list due to the changing listing requirements of the Tokyo exchange. By listing prior to the reorganisation of the Tokyo market, CEL was able to list on the second section and then transfer to the new “standard” market. As a result, CEL was able to take advantage of more relaxed listing rules for continued listings, including lower requirements for float and traded volume.

These transitional rules for continued listing were only eligible for companies that listed before April 4, 2022. (Note that CEL listed only one month earlier.) Companies eligible for these transitional rules only require a tradeable share ratio of 5% or higher, and a monthly average trading volume of 10 units or more. However, the standard rules for continued listing on the Standard Market require a tradeable share ratio of 25%. CEL would not meet this requirement, and it may have factored into Mr Shinno’s decision to list earlier rather than later.

Here are a few further points that help explain why this situation is available:

CEL’s prospectus was issued prior to the release of the full year results which included the extraordinary gain on sale of the Chinese subsidiary. The true value wouldn’t be immediately apparent to casual readers. The prospectus however does mention the sale was taking place, and the price.

The prospectus was made available in February, which was when Russia invaded Ukraine. Market sentiment was low. CEL listed a month later in March.

CEL has a small market capitalisation and an even smaller float. At today’s prices, the 522,100 shares made available to the public at listing are only worth ¥1.1B, which is approximately $11.6MM AUD.

CEL’s business model

CEL has a vertically integrated business model, covering most aspects of the apartment business. For a more detailed description of the business model, I would suggest looking at the company’s presentations available on its website.

Rental housing

In the rental housing business, CEL sells steel-framed rental apartments that are constructed using steel manufactured at its own plant in Chiba City. It primarily sells apartments to investors in Japan, such as salarymen, etc, for rental. The apartments are very compact, ranging from 22–40 sqm, and are primarily marketed at young singles aged 25 to 35 in the Tokyo metropolitan area. This is a major segment of the rental market: according to research by Savills, one-person households account for 67% of privately run rentals in Tokyo.

CEL has a number of different layouts for different customer segments. The company is trying to differentiate itself by providing flexible floor plans that maximize living space. CEL’s apartments also have a distinctive red-brick appearance, which the company believes is more attractive to younger people compared to traditional-style apartments.

Tokyo has remained a popular destination for younger people through the pandemic, while there has been net migration for people aged 35-49.

It is important to note that real estate in Tokyo is very expensive, especially for younger people who typically do not earn high incomes. As a result, people tend to live in very small apartments, many of which have only space for eating/sleeping/relaxing.

CEL’s designs try to maximise space available, while making the apartments as liveable as possible. For example, some designs make use of alcoves or raised floors to provide extra living space.

According to the company presentation, about 45% of sales come from referrals (e.g. financial institutions, real estate agents), 25% come from word of mouth and 30% are repeat sales. In 2022, CEL introduced a new sales management system and shortened the period from contract to construction by 30 per cent.

For the year to February 2023, CEL is forecasting a 7 per cent increase in sales and a 35 per cent increase in profits for the rental housing segment. They are boosting the employee count and taking measures to deal with cost inflation. They’re also seeking to increase the share of sales from referral to 50% and reduce construction times.

The rental housing segment had sales of ¥7.2B in FY21 (ending February 28, 2021) and ¥8.5B in FY22. Operating profit was ¥257MM in FY21 (3.5% margin) and ¥455MM in FY22 (5.4% margin). CEL is forecasting rental housing sales of ¥9.07B in FY23 and ¥614MM in segment profit (6.8% margin).

Rental development

In the development segment, the company purchases land in desirable locations near train stations, etc. It develops these sites into apartments to sell to investors. The business takes advantage of inheritance tax concessions available for apartments in Japan.

The business is focused in the Jonan and Josai areas of Tokyo. CEL physically purchases land lots covering 100 tsubo (330 sqm). A typical development will have 12 apartments, or average apartment size of 27.5 sqm.

This segment had sales of ¥3.2B in FY21 and ¥1.96B in FY22. Operating profit was ¥264MM in FY21 and -¥3MM in FY22. CEL is forecasting development sales of ¥3.05B for FY23 and segment profit of ¥237MM (7.8% margin).

Rental management

CEL also offers rental management services, such as tenant recruitment, move-in/move-out management, rent collection, building inspection and cleaning. As of February 28, 2022, CEL managed 11,228 apartments (4.55% increase YOY) up from 10,739 in 2021 (7.15% increase YOY) and 10,022 in February 2020. Mr Shinno told Nikkei that CEL ends up managing about 60% of the apartments it builds, while the remaining 40% are self-managed or managed by other operators.

CEL also operates a rental guarantee business under its subsidiary Celerent Partners Co Ltd, which is consolidated in the company’s financial statements. In Japan, all renters must have a guarantor on their lease. Renters often use relatives as guarantors, but there are requirements around income, which means that retirees can be ineligible. Also, some people understandably don’t want to ask their parents to be guarantors. Foreigners, too, have a problem as generally guarantors need to be Japanese citizens. As a result, companies such as CEL provide guarantor services for a fee. CEL typically charges between 50-100% of one month’s rent for its guarantee service, and 10,000Y for renewal. This is a high margin business with little capital requirements and it makes sense for CEL, considering its involvement in selling and renting apartments.

The occupancy rate was 97.9% in FY22 compared to 97.6% in February 2021 and 98.7% in February 2020. CEL expects gross profit in the management business to rise by 8% over FY23, but operating profit to stay flat, as CEL is boosting its employee count.

Shareholders

CEL has 3,467,064 shares outstanding after deducting treasury shares. Mr Shinno owns 2,006,000 shares via his investment vehicle J Corporation Co Ltd and a further 98,000 shares in his own name (60.25% of the company in total).

Makitech, an unlisted manufacturing company based in Nagoya, owns 400,000 shares (11.54%), while the CEL employee shareholding association owns 153,800 shares (4.44%).

The remaining major shareholders are mostly brokerage firms and custodians. There is very little institutional or foreign ownership, which is unsurprising considering CEL’s market cap and limited liquidity.

Management and culture

CEL management uses a Japanese management system created by Kazue Inamori, founder of multinational manufacturer Kyocera, called “amoeba management”.

Amoeba Management begins with dividing an organization into small units called "amoebas." Each amoeba leader is responsible for drafting plans and goals for the unit. Amoebas achieve their goals through collaboration and the hard efforts of all their amoeba members. In this system, every employee plays a major role and voluntarily participates in managing the unit, achieving what is known as "Management by All."

In a Q&A in May, management said:

Specifically, we are thinking of increasing the number of employees by about 20%. As a listed company, we are thinking of increasing the number of personnel by about 20% from the viewpoint of fostering successors in the future by increasing the layer of human resources. We are currently introducing Kyocera's Amoeba Management. Under these circumstances, we recognize that hiring excellent human resources and fostering successors are important issues in order for the unit manager of each unit to develop a sense of management. As a permanent company, we believe that the most important thing in the future is to strengthen human capital, so it will affect the profit and loss for a single year, but as a medium- to long-term strategy, we will invest in human resources and development.

CEL has eight directors of which two are independent. The board consists of Masatsugu Shinno (founder, president and chairman of the board), Takanori Yamaguchi (managing executive director, GM of administration headquarters), Masayoshi Nishimoto (director), Kenichi Suzuki (managing executive director, rental development), Masami Tsuchiya (managing executive director, rental management), Masashi Oshima (director and risk management officer), Takashi Yamashita (independent outside director and Mamoru Watanbe (independent outside director - housing background). Mr Shinno, 78, controls the board and has little oversight. We are really investing alongside him here.

CEL uses the “kansayaku” system of corporate governance, which is common in Japan. The kansayaku are corporate auditors that oversee the board, but they can’t vote on proposals e.g. to remove the CEO. There are two people on the kansayaku board, Taku Osawa (lawyer) and Toru Shiraishi.

Key financial data

First half results and FY23 guidance

CEL reported Q2 results on October 14. For the first half, CEL recorded revenue of ¥10.2B and operating profit of ¥633MM. This compares to FY23E forecasts of ¥19.9B revenue and ¥931MM operating profit.

The development segment, which is lumpy, benefited from project completions in the first half and contributed ¥224MM in profit compared to full year guidance of ¥237MM.

Earnings in the second half are difficult to predict due to the the unpredictability of housing/development profits, etc. But as CEL has already earned 68% of forecast full-year operating profit in the first two quarters, the full-year guidance seems low.

You can see the implied second half numbers in the table below.

Valuation

There are two parts to valuing CEL, the operating business and the cash. If we ignore the cash, the market cap is currently 7.86x forecast FY23 operating earnings of ¥930MM. Operating earnings are also at the lowest level in the last seven years, so there could be room for improvement.

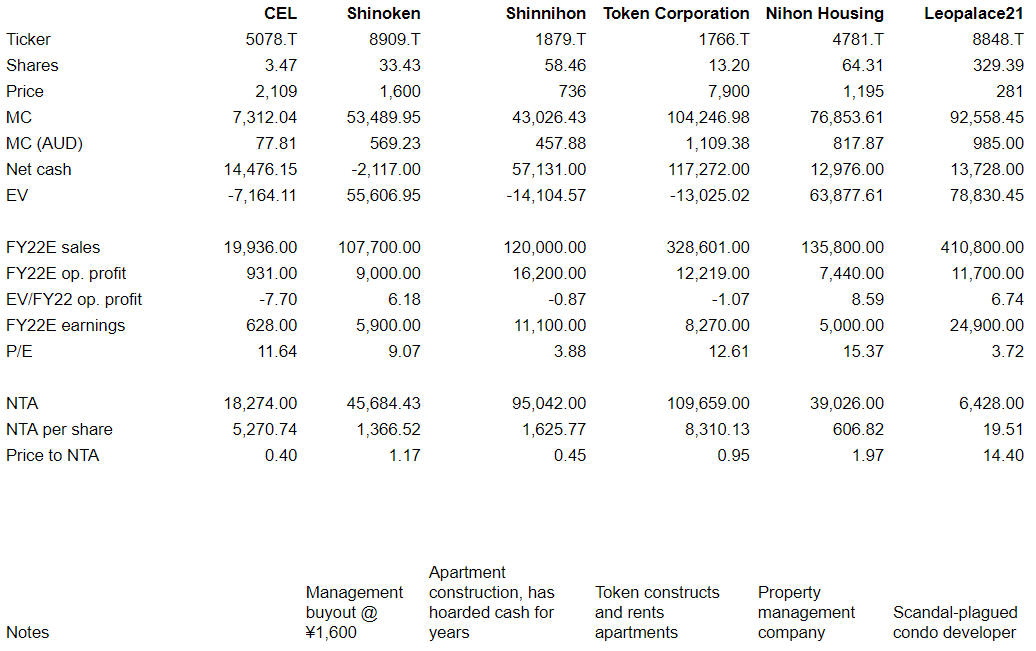

There are a number of comparable companies, the best of which is probably Shinoken (8909.T). Shinoken has a similar business to CEL and was bought out in a management buyout recently for ¥1,600 per share (6.2x EV/operating profit).

Another reasonable comp is Token Corporation, which has a construction and rental management business like CEL. Token trades at P/E of around 12.6x and close to the value of its tangible assets.

The outlier among the comps is Shinnihon (1879.T), which is purely a construction company. Shinnihon trades at a negative enterprise value, P/E of 3.9x and around half book value. However, Shinnihon has held large cash balances on its balance sheet for years, so it deserves to trade at a discount to NTA. LeoPalace21 also trades a very cheap multiple of earnings, 3.7x, but it has a very weak balance sheet and has been embroiled in a faulty construction scandal.

I think the current market cap is around fair value for CEL’s operating business. ¥7.3B certainly doesn’t seem like a demanding price to pay for a business that has earned ¥8.4B in operating earnings over the last six years.

That leaves CEL’s cash. There are a few approaches you could use here:

You could value the cash at 100 cents on the dollar. CEL has net cash of ¥14.5B or ¥4,175 per share. If we assume the operating business is worth roughly the market cap today, that would imply a total value of around ¥6,284 per share. That is approximately 1.2x CEL’s NTA of ¥5,271 per share.

You could simply apply a discount to the cash. As CEL’s cash is not going to be paid out to shareholders, the market is likely to discount it. I think a reasonable discount in this case may be around 25%. That would value the cash at around ¥10.9B (¥3,131 per share). If we assume a 50% discount, which seems excessive, you would still have ¥7.2B (¥2,088 per share). If we add back the value of the operating business, that would imply a value of ¥4,197–¥5,204 per share. This seems to me to be more rational range for CEL to be trading in the market currently.

As we know the cash is most likely going to be invested, we could make assumptions about future earnings from acquisitions. The quantum of cash means that even a poor investment would significantly increase CEL's earnings. For example, if you assume CEL invests ¥12B at only a 5% post-tax rate of return, that would generate ¥600MM additional annual earnings, boosting EPS by ~96% based on the company's FY23 forecast net profit of ¥628MM. At a 10% return, earnings would be boosted ¥1.2B (+191%), etc. If we assume the acquisitions happen in two years’ time, which seems reasonably conservative, and apply a discount rate of 12%, the present value of these future annual earnings would be in the range of ¥478.3MM to ¥956.6MM, assuming a 5% and 10% return respectively. (Of course, CEL could well do better than 10%, but I’m keeping my expectations low.) If these earnings are capitalised at the current P/E ratio, 11.64x, that would value the cash at between ¥5.6B and ¥11.1B — ¥1,605 and ¥3,211 per share respectively. If we add back the operating business, we would be left with a total value of between ¥3,715 and ¥5,321 per share. If we add back the remaining ¥2.47B cash, the valuation range improves to between ¥4,429 and ¥6,035 per share.

Thus, we end up with a valuation range of ¥4,197–¥6,284 per share, implying upside of 99% to 197% from today’s prices. I do not think my numbers are overly aggressive here. In fact, even when using extremely pessimistic assumptions, CEL appears deeply undervalued. In my view, this is what makes CEL a particularly attractive investment.

Risks

Capital allocation

CEL’s asset backing provides significant downside protection. However, management could misuse the cash or hoard it. While this is a key risk — the most important one for CEL investors to my mind — there are some mitigating factors. Firstly, Mr Shinno has a huge ownership stake in the business. Secondly, CEL seems to treat minority shareholders decently: for example, it has a reasonable dividend policy. Also Mr Shinno’s decision to sell his own shares into the listing at deeply discounted prices rather than issue dilutive new shares could be seen as a positive for minorities. Finally, the valuation is so low that even with poor capital allocation, investors should still do well.

Currency risk

As an Australian investor, my results will be influenced by the JPY/AUD exchange rate. At the moment, the yen is cheap by historical standards. I don’t have a particular view on exchange rates from here, but I think the yen exposure is not a cause for significant concern.

Interest rate risk

The Tokyo real estate market is vulnerable to changes in interest rates. BOJ Governor Kuroda is keeping long-term interest rates around zero and short-term rates at minus 0.1%, however CPI is currently running at 3.6%.

According to a report from Reuters:

Economists do not expect the BOJ to join a global trend of raising interest rates, because it sees this year's acceleration in inflation as a cost-push episode that will fade as import costs stop pushing.

Foreign supply constraints have driven up prices of imported food, industrial commodities and manufacturing parts, and so has a fall in the yen, which in dollar terms is down more than 20% this year.

"I haven't changed my view that the rise will start to slow down soon," said Takeshi Minami, chief economist at Norinchukin Research Institute, noting declines in global grain prices. "I expect inflation to peak by year-end and the rise in prices to start diminishing in the new year."

Meanwhile, a recent research report by real estate firm Savills noted:

According to Savills in-house surveys, transaction cap rates for mid-market residential properties in Tokyo have narrowed to 3.3% as of Q2/2022, and winning bids of prime assets could certainly be much tighter in reality …

Although the Bank of Japan (BOJ) repeatedly reaffirmed its stance to keep its monetary policy in place, the stark difference between the stance of the BOJ and global counterparts has further weakened the yen, making some investors worried about possible interest increases in Japan. With yield spreads already slim due to low cap rates in the residential sector, it is possible that some start to freeze new investments if the uncertainty increases.

While the cap rates for residential property in Tokyo are low, the alternatives are also unattractive. Japan’s government bond currently yields under 0.3% while the Nikkei 225 index has a dividend yield of around 2.25%.

Tokyo apartments seem somewhat expensive, but certainly not in bubble territory. The average annual income per household in Japan is ¥489,745 per month, about ¥5.9 million on an annual basis. A 25 sqm CEL apartment should be worth around ¥27-37MM depending on location, which implies a multiple of 4.6–6.3x average household income. As wages in Tokyo should be higher than the national average, the multiple is likely lower than that in reality.

As the majority of CEL’s profits come from its rental management business, which should be less cyclical, it is likely less exposed to interest rate risk than competitors. Again, we have a significant margin of safety thanks to CEL’s low valuation.

Potential overhang

The Tokyo exchange hasn’t put an end date on the transitional listing rules as yet. However, it is likely that CEL will eventually need to meet the Standard Market’s regular 25% float requirement, which could require major shareholders to sell down more of their stake or CEL to issue more shares. CEL has flagged this in its financial reports. While this could create a short-term headwind for the stock, I don’t think it is a cause for major concern.

Language barrier

CEL’s financial reports are in Japanese, and they do not provide English translations. I have relied on machine translations of the prospectus and other financial reports. The financial data itself is filed in XBRL format, which is very easy to access and read via Kaijinet. While I have a high degree of confidence in my research, it could be difficult to keep up with day-to-day news items about CEL. I do not think this breaks the thesis.

Catalysts

My thesis is that CEL is ultimately an overlooked and misunderstood company. Any attention from analysts, investors etc. could see the share price rise substantially.

I expect CEL will announce an acquisition or potentially another use for the cash within a year or two.

CEL’s large cash balance could attract activist investors who could push for a distribution instead of an acquisition.

Appendix: CEL IR Q&A

My questions to CEL IR and their responses are below. N.B. The cash balance is now ¥14.7B not ¥19.5B due to taxes, etc.

According to CEL’s financial statements, the company holds 19.48b yen in cash and deposits following the disposal of the Chinese business. Is this cash deposited in Japan? Is it freely available for the company to use as it pleases?

The proceeds from the transfer of the China business were deposited in a Japanese bank and converted to yen as of December 22, 2021.

The funds are managed in our bank account and are at our disposal.

At listing, CEL shares were offered to the public at ¥1,900. Yet according to the financial statements, CEL had ¥5,503 yen per share net asset value as of February 28. I’m wondering why the founder was prepared to sell some of his holdings at such a large discount to net asset value?

The purpose of listing in our company was to further strengthen governance, not to raise funds. Against this background, we had planned to issue new shares at the time of listing, but due to the unplanned acquisition of funds associated with the transfer of our China business just prior to the approval of listing, it became difficult to issue new shares. Therefore, in order to fulfil the purpose of the listing, our representative director decided to sell his shares.

The company has announced it intends to increase its number of employees by 20%. What is the reason for the increase? Which business segments will the new employees work in?

In order to achieve our management policy of "sustainable and stable growth," we recognize that recruiting excellent human resources and fostering successors are important issues, and we have set investment in human resources as our mid- to long-term strategy. In the current fiscal year, we plan to increase the number of employees as an upfront investment for the future, with a particular focus on acquiring excellent human resources and fostering them. We are hiring based on the recruitment plans of each business unit, and new employees will be hired by the relevant business unit.

The company now has a very significant cash balance. What does the management intend to do with the cash? Will they look at acquiring other businesses or would CEL prefer to invest in its own business?

Our policy is to use the funds obtained from the sale of the China business to invest in businesses that will bring synergy to our current business and lead to increased profits and further growth, but we would like to continue discussions and make a decision based on the current global situation and market conditions.

Considering the current share price and the large cash balance, is management considering the option of paying a special dividend?

The Company's dividend policy is to provide a stable return to shareholders with a target payout ratio of 30%. For the fiscal year ending February 28, 2023, we plan to determine the dividend based on the previous fiscal year's (fiscal year ended February 28, 2022) dividend of 80 yen per share. No special dividend is currently contemplated.

Now the company is listed on the “Standard Market”, will it need to take measures to meet the requirement for a tradeable share ratio of 25%? How would CEL meet this requirement?

Since our company will be listed beyond the period, the number of shareholders and shareholder composition after listing will only be known as of August 31, the end of the second quarter. At that stage, we will confirm whether the requirements for the ratio of shares in circulation are met and consider how to respond to the situation.

Does the company have a target for a growth rate in terms of sales or profits?

Although the China business was transferred in the previous fiscal year, our policy is to aim for solid growth in sales and operating income from our domestic business in Japan, with the goal of increasing sales and operating income by 5-10% each year, while keeping a firm footing and avoiding unreasonable expansion.

According to the company’s presentation, the profit margin for the rental management business is expected to drop from 12.3 per cent to 10.8 per cent over the coming year? What is the reason for the decrease in margins?

In the current fiscal year (ending February 28, 2023), the Company is working to strengthen its foundation for future sales and profit growth by bolstering its sales force through increased headcount and enhancing services for owners. We expect a temporary increase in expenses and a decline in segment profit margin due to the increase in headcount as an upfront investment.

The occupancy rate has somewhat declined from 98.7 per cent to 97.9 per cent from 2020 to 2022. What is driving this? Does CEL target a specific occupancy rate?

The occupancy rate was 98.7% for the period ending February 2020, 97.6% for the period ending February 2021, and 97.9% for the period ending February 2022, a temporary decline due to the impact of the new coronavirus in the period ending February 2021. The rate temporarily declined in the fiscal year ended February 2021 due to the impact of the new coronavirus. This was also due to the impact of the number of vacancies in properties managed by other companies, which affected the number of vacancies in the replacement of existing properties under consignment, a full-scale effort that began in the fiscal year ended February 28, 2021. The occupancy rate for the fiscal year ending February 28, 2022 and beyond has been maintained at a certain level. Although the future outlook is uncertain, we are targeting an occupancy rate in the upper 97% range for the future (at the end of the fiscal year).

A well-structured write-up and pleasure to read. The back-and-forth with their IR was definitely useful. I’ll dive in soon and leave more constructive thoughts! Btw, I also pitch investment ideas and would love to recommend your Substack to my readers. If you like my work (I think you can see the link here?), would you consider doing the same?

I have a feeling that main purpose of listing, with its inherent better liquidity/transferability of ownership and at least stated aim of "better corporate governance" could be estate planning; to be able to enable better transition of ownership into next generation, especially if there are several heirs. Given the stated age of the main shareholder it is even more likely that that could be the main reason. Are there any children involved in company's management or there have been any talk about succession?