Japanese net-net trading at 7x PE with positive earnings outlook

A consistently profitable electronics trading company selling at a 30% discount to NCAV.

Hello again. It’s been a while since my last write-up. That’s mostly because I’ve been busy with work and family, but partly because I have a lot more readers and I feel some extra pressure when writing up ideas. While the other stocks I’ve written about have done well, I can assure you that I have plenty of losers and I often make mistakes with my analysis. Please keep that in mind when reading this post or anything else from me.

Today, I’m introducing another Japanese net-net. The stock is Mitachi Co Ltd (3321.T). Mitachi is an electronics trading company based in Nagoya focusing on semiconductors and electrical components. Mitachi’s main customers are in the automotive and amusement industries (e.g. pachinko machines). Mitachi also has a business manufacturing electronic components and also sells assembly equipment for electronic devices.

I came across Mitachi while flicking through the Japanese Company Handbook, a paper manual of Japanese companies published by Toyo Keizai. Here’s the page.

The photo doesn’t capture the market cap, which was ¥8.6B. What I thought was interesting about Mitachi was the fact that it had a decent chunk of net cash (¥3.2B or roughly 37% of the market cap), it traded at a low multiple of operating earnings (under 5x on a market cap basis or ~3x if you subtract the cash), it paid a decent dividend (over 4%, which is high, especially considering the cash rate in Japan), and it had better ROE than your average low P/B Japanese stock.

After doing some more work, I found a few other interesting tidbits.

Going back to FY02, Mitachi has only had one unprofitable year, FY12. Mitachi posted profits during both the GFC and the COVID period.

Mitachi is forecasting ¥80B of sales over the next financial year (ending May 31, 2025), more than double FY24 sales of ¥38.9B. This uplift seems largely due to the company taking over a sales and distribution agreement for DENSO Corporation, a major Japanese auto components manufacturer. (N.B. This forecast is not captured in the handbook page, but has been disclosed in company filings.)

Mitachi also recently released a mid-term management plan covering the three years to May 31, 2027. Management has listed three goals for FY27: sales of ¥100B (vs. ¥38.9B in FY24), operating profit of ¥3B (vs. ¥1.6B in FY24) and ROE of 10% (vs. 8.9% in FY24).

It’s a net-net: Mitachi’s current assets less total liabilities exceed its market cap.

On face value, Mitachi seems extremely cheap. Mitachi’s shares last traded at ¥1,097 and the company has just under 8 million shares outstanding. Thus, the market cap is roughly ¥8.74B at current prices. The company has ¥12.4B in net current asset value (current assets less total liabilities), equivalent to ¥1,563 per share, and ¥14.3B in net tangible assets (~¥1,800 per share). The company is guiding to a ¥50 dividend, which implies a yield of 4.56% at current prices. It is trading at a forward P/E of 7x, less than 5x operating earnings and 0.11x sales. Meanwhile, if we are to believe the mid-term management plan, the company is saying it can grow operating earnings at 20.7% CAGR over the next three years. I don’t know about you, but those kinds of numbers pique my interest.

Mitachi’s recent operating history

I’ve summarised Mitachi’s key financial information over the last 10 years in the table below. While earnings have been volatile, you will see that Mitachi has posted operating and net profits in each of the last 10 years. Average annual operating income over the period is ¥1.27B, while net income has averaged ¥906MM.

Over the last nine years, net assets have grown from ¥6.7B to ¥14.5B, about 9% CAGR. ROE meanwhile has averaged 9.5%, which is not great, but much better than typical deep value Japanese stocks.

Roughly two thirds of sales are in Japan, and one third is overseas, with the largest export markets being China and the Philippines. Mitachi has customer concentration, with its largest customer Aisin Group, a member of the Toyota group of companies, accounting for 23.2% and 28.9% of sales in FY23 and FY24 respectively. The second largest customer is Brother Industries accounting for 16.2% and 15% of sales over the same period. These are long-standing relationships but the concentration does present a risk.

The business outlook appears quite good for Mitachi after a difficult FY24 which saw operating profit fall 36.1% YOY and sales fall 10.1% YOY. Mitachi’s full-year report notes that the company expects a recovery in the industrial equipment and consumer fields and solid orders in the automotive field.

Here is a breakdown of sales by product and segment for the last three financial years.

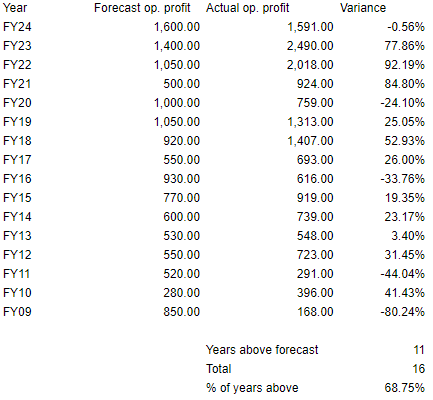

Looking at the company’s past forecasts, we can also see guidance has been typically conservative. I don’t think we should put too much emphasis on this, but it does suggest management are restrained in their forecasts.

Recent developments

DENSO contract

When I first looked at Mitachi, I couldn’t understand why sales were expected to grow over 100% over the coming year. However, after reading the filings, it’s clear that the increase is largely due to Mitachi taking on a sales and distribution agreement related to DENSO Corporation.

This arrangement was first announced in August 2023, but Mitachi has said sales will start in Q2 this year. Importantly, this suggests that the ¥80B of forecast sales for this year only factors in three quarters of the DENSO contribution. If you look at the guidance for the first half, it implies ¥50B of sales in the second half (or ¥100B if you annualise the second half). Thus, it seems likely that FY26 sales will be higher than FY25.

Mitachi didn’t pay anything to take on the DENSO sales contract from the previous distributor, Toshiba Electronic Devices & Storage Corporation (a subsidiary of Toshiba). This seems unusual, and I find it puzzling. When I asked Mitachi’s IR in an email about the arrangement, this is the response I received (translated from Japanese by Google):

Toshiba Electronic Devices & Storage Company and our company have been working together for mutual benefit under a long-term business partnership agreement. The transfer of DENSO's commercial distribution has also been carried out with the aim of making maximum use of the resources held by both companies as partners.

It seems the DENSO distribution arrangement could be very low margin as Mitachi is forecasting only 13.1% growth in operating profits compared to 105.7% growth in sales. Another explanation is that Mitachi is simply lowballing guidance. I don’t have a strong view on this. It seems we will have to wait and see how the company performs over the next few quarters before we can make a proper assessment.

The August 2023 announcement about the DENSO deal also included some financial information about Toshiba Electronic Devices & Storage Corporation. We can see that the company was profitable in each of the three years from FY21-FY23, with an average ordinary profit margin of 6.2% over that period, which is higher than Mitachi’s margin.

However, as DENSO sales were only a fraction of total sales, we don’t know the margin profile of this business. If we assume annual Denso sales of ¥60B, it would be less than 10% of Toshiba Electronic Storage and Device’s FY23 revenue. All that said, it seems unlikely that Toshiba would hand off the distribution deal for free if it was a great business. Similarly, I can’t imagine Mitachi’s historically conservative management would take on this deal if they thought it would be onerous. Thus, I think the most likely explanation is that this is a low margin business but a profitable one.

Credit line

As you can imagine for a distribution business, the huge increase in sales requires more working capital. On July 5, Mitachi announced it had entered an agreement with major Japanese banks for a committed credit line of up to ¥20B. This amount is more than double Mitachi’s current market cap and ~40% more than the company’s current book value.

Under the arrangement, MUFG has committed up to ¥14B and Mizuho a further ¥6B. Here are the details from the announcement, again translated by Google, so there may be errors in translation.

Purpose:

The conclusion of this agreement will enable stable and flexible fund raising, which will enable the company to meet capital needs associated with future growth. The purpose of this is to respond to changing business conditions and strengthen our financial base.

Details of the credit line:

(1) Contracting parties: MUFG Bank, Ltd. and Mizuho Bank, Ltd.

(2) Maximum loan amount: ¥20B (MUFG Bank, Ltd. ¥14B, Mizuho Bank, Ltd. ¥6B) Revolving method

(3) Contracting date: September 18, 2024.

(4) Contracting period: MUFG Bank Ltd., September 30, 2024, to September 29, 2025 (one year); Mizuho Bank, Ltd., September 25, 2024, to September 24, 2025 (one year).

(5) Contract type: Individual bilateral agreement

(6) Use of funds: Working capital

(7) Collateral: Unsecured and unguaranteed

Future outlook

The impact of this matter on our consolidated financial results is expected to be minor.

While the agreement is unsecured and unguaranteed, Mitachi’s filings indicate that there are covenants regarding the maintenance of net assets and profits.

The amount of debt involved creates additional risk, especially if Mitachi loses money on the DENSO distribution. The fact that Mitachi has been conservative and consistently profitable in the past is reassuring in this regard.

Ownership structure

Mitachi’s largest shareholder is JU Corporation, an investment vehicle for Mitachi’s president Kazuhiro Tachibana. JU owns 23.16% of Mitachi’s stock. It appears Kazuhiro Tachibana owns a further 2.8% of shares directly. The next largest owner is Sumitomo Mitsui with 3.6% and MUFG Bank with 2.5% of shares. While insider ownership is good, the lack of another large shareholder means there are no real checks on the board or management, which isn’t unusual in Japan.

Why I like Mitachi

If we assume that Mitachi is able to reach its FY27 goal of ¥3B operating income, that would imply 20.7% CAGR over the next three years. On top of that, we are collecting a dividend of roughly 4.5% at current levels. Thus, even if the operating income multiple stays the same as today (~4.9x), there is still a path to 25% returns over the next few years via earnings growth and dividends.

Of course, the forecasts could be overly optimistic. If we are more conservative and assume management is able to grow operating income by 10% each year over the next three years, shareholders would still do very well with roughly 15% annual returns from earnings growth and dividends alone.

We could also benefit from improved ROE, improved corporate governance and more shareholder friendly policies. All of the above seems possible considering the push by Japan’s government and the Tokyo exchange.

While semiconductors are notoriously cyclical, Mitachi is simply a distributor and the automotive business should have some tailwinds over the medium term. New cars need lots of semiconductors and hybrid cars (which seems to be one of DENSO’s key end markets) seem to be performing well recently. Here is some background from a report by S&P Global Mobility.1

There is a positive long-term outlook for the automotive semiconductor industry in 2025 and beyond; S&P Global Mobility forecasts that industry revenues will exceed $130 billion by 2029. After the inventory reset in 2023 and 2024, normalized demand from OEMs and Tier 1 suppliers is expected to drive the automotive semiconductor market forward in 2025.

Electrification is also expected to continue as a pivotal trend within the technology landscape, exerting a significant influence on the dynamics of the automotive semiconductor market with a turnaround expected for BEVs in 2025.

Why is this cheap?

I always try to understand why a stock might be overlooked or mispriced. With Mitachi, there are a few factors that could explain why the stock is trading where it is.

This is a small company with a market cap of roughly $60MM USD. As a result, the idea is too small to move the needle for fund managers or institutional investors. I’m also not aware of any analysts covering the stock either, which would make sense considering the company size and liquidity.

While Mitachi has made some disclosures about the DENSO deal and its mid-term management report, it’s plausible that these filings haven’t been widely read by market participants. The stock is basically flat since August 2023, which is when the DENSO agreement was announced.

There are very few foreign investors involved here. According to the company handbook, foreigners only owned 6.3% of the company.

Risks

While Mitachi has been consistently profitable, the new DENSO deal could lead to losses. The company is also taking on a lot of debt to fund the increase in working capital.

We don’t have any real insights into the margin profile of the new DENSO business, so we have to make assumptions.

As both an importer and exporter, Mitachi is exposed to fluctuations in the yen exchange rate. The company uses hedging to avoid large risks, but it would still be affected to some extent by sudden fluctuations.

If there was a sudden decrease in orders from customers, Mitachi could be left holding excess inventory.

Mitachi has historically had significant customer concentration, with its top two customers accounting for over 40% of sales in FY24.

Appendix: Q&A with Mitachi’s IR

As part of my research, I sent the following questions to Mitachi’s IR department.

Your guidance for FY2025 states that sales will increase by 105.7%, but ordinary profit will only increase by 5.5%. Can you explain why the sales and operating profit forecasts differ?

I would like to know more about DENSO Corporation's distribution agreement. What margins do you think you can achieve on this business?

From your guidance, am I correct to assume that margins on additional sales from DENSO will be very low? Do you think margins will improve over time?

Could you please explain how the distribution business with DENSO will work? Will Mitachi hold DENSO inventory? How will Mitachi get paid under this agreement? What risks are involved?

Was the DENSO business profitable for Toshiba Electronic Devices & Storage Corporation, the previous distributor? Do you know why Toshiba would want to stop selling DENSO products? We are trying to understand why they would want to lose this business

Could you please explain the purpose of the new credit facility? 20 billion yen seems very large compared to your current capital and assets. Is it to support working capital for the DENSO business? Are there any other purposes?

In your mid-term business plan, you had set a target of 3 billion yen in operating profit in 2027. This is significantly higher than your current operating profit level. How does the company intend to increase its operating profit? How confident are you of achieving your target?

How will fluctuations in exchange rates affect the company's operations and profitability?

The company's valuation seems very low compared to its assets and earnings. What measures will the board and management consider to increase the company's share price?

What do the company consider to be its main risks over the next few years?

Here is the response I received:

Regarding sales and operating income, we announce our forecasts taking into account sales forecasts in each field. The main fields are automobile-related, industrial equipment-related (machine tools, etc.), consumer (OA equipment, electronic musical instruments, etc.), and amusement (game machines, games, etc.). The forecasts are for other fields (infrastructure-related, etc.) and are based on forecasts for each field, region, and customer, taking into account fixed expenses and human investments.

Regarding sales to Denso, we will refrain from commenting on individual profits.

We do not disclose profit margins for individual customers, so we will refrain from answering that question. As for our overall activities, we are striving to continually improve our profit margins.

Mitachi plans to hold inventory to ensure smooth sales and service. We will refrain from answering questions regarding payment terms, as this is an individual contract with each customer. Regarding risks, there is a risk of inventory increasing if there is a sudden decrease in orders due to customer production or internal and external factors.

Toshiba Electronic Devices & Storage Company and our company have been working together for mutual benefit under a long-term business partnership agreement. The transfer of DENSO's commercial distribution has also been carried out with the aim of making maximum use of the resources held by both companies as partners.

The purpose of the credit line is to obtain working capital, including for the DENSO business (and others).

With regard to the target of 3 billion yen in operating profit for fiscal year 2027, we will improve the profitability of products sold and services provided, as well as use selling and administrative expenses efficiently. We will work to expand our product services in new fields. We are working as a group to achieve our goal.

Regarding exchange rates, we have both export and import transactions, so it is difficult to say either way. We take measures such as currency hedging to avoid large risks, but if there is a sudden fluctuation in the exchange rate, there is a possibility that we will be affected to a certain extent.

Regarding our stock price, we will continue to strive for sustainable company growth, improved profitability, and timely investor relations.

The risks we are aware of will be described in our securities report, which we plan to disclose at the end of August.

Further reading

As always, I’d be curious to hear if anyone has any feedback or pushback on this idea. If you leave a comment, I’ll do my best to respond.

https://www.spglobal.com/mobility/en/research-analysis/briefcase-automotive-semiconductor-industry-positive-outlook.html

Great article. Do you plan to follow up/update after their securities report later this month?

Any update on this one? Any concerns about the increase in inventory and debt and whether the growth will have enough return on that?